IBAN Checker – Validate and Verify Your IBAN Online

Free IBAN Checker Tool

Instantly check and validate your IBAN number to ensure it’s formatted correctly and follows international standards.

What is an IBAN?

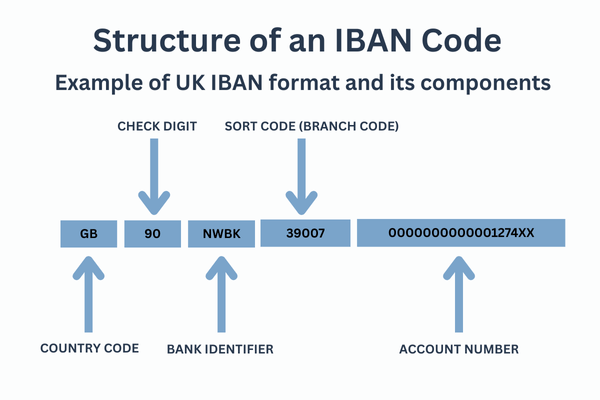

An IBAN (International Bank Account Number) is a standardized format used to identify bank accounts across borders. It ensures payments are sent to the correct account by including key details like the country code, check digits, bank identifier, and account number.

What Does Our IBAN Checker Do?

Our IBAN checker tool verifies if the IBAN number you entered is valid, correctly structured, and follows the official formatting. It helps with:

- IBAN structure validation

- Country-specific IBAN checks

- Check digit verification

- Confirming correct IBAN length

Note: This tool validates IBAN structure only. It does not verify account ownership or existence.

How IBAN Validation Works

When you check an IBAN, the tool performs three key steps:

- Moves the first 4 characters to the end

- Converts letters to numbers (A=10, B=11… Z=35)

- Performs a modulo 97 check — a valid IBAN always gives remainder 1

Common Uses for IBANs

- Sending and receiving international payments

- Bank transfers within SEPA and Europe

- Avoiding failed or delayed payments due to incorrect IBAN formatting

If you’re sending money abroad, using the right IBAN is critical.

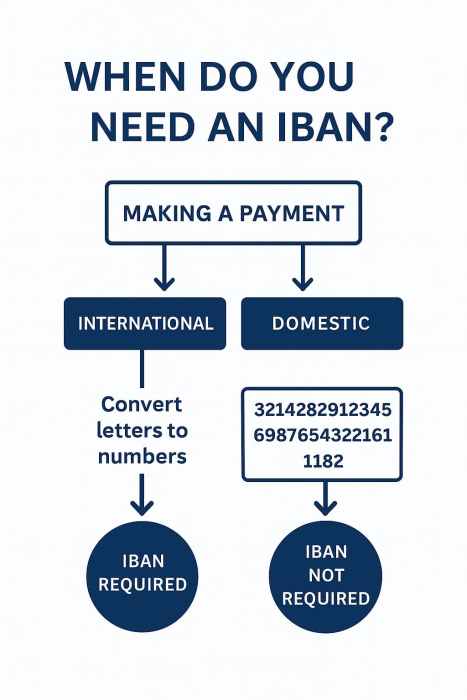

When Do You Need an IBAN?

You’ll need an IBAN if you’re making or receiving an international payment—especially within Europe or SEPA countries. Domestic UK payments typically don’t require one, but international banks often will.

Common IBAN Questions Answered

How can I check if an IBAN is valid?

Use our IBAN validation tool above. Paste your IBAN and click “Check”. We’ll verify its structure, format, and check digits.

Where do I find my IBAN number?

Your bank statement, online banking dashboard, or mobile banking app will show it. UK banks like NatWest and Barclays display IBANs under account details.

How long does an IBAN transfer take?

Typically 1–3 business days for SEPA transfers. International payments may take longer.

Can I check who owns an IBAN?

No, ownership verification requires bank-level access. This tool checks format only.

What if I enter the wrong IBAN?

If the structure is incorrect, the transfer may fail. If it’s valid but belongs to someone else, funds may go to the wrong person. Always double-check.

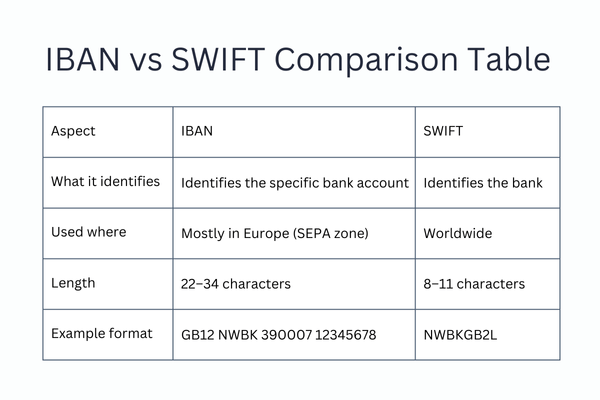

IBAN vs SWIFT: What’s the Difference?

IBAN and SWIFT codes are both used in international banking, but they serve different purposes. Here’s a quick comparison:

Avoid These IBAN Mistakes

- Typos – Always copy & paste IBANs where possible.

- Incorrect Format – Enter the IBAN as a continuous string (no spaces).

- Missing Details – Some banks may need additional information for international transfers.

Related Tools and Services

Looking for different ways to validate your international bank details? Our tool supports a variety of use cases:

- IBAN validator – instantly check if an IBAN is correctly structured.

- IBAN number checker – validate the account format for any supported country.

- Validate IBAN online – no signup needed, free and fast.

- Verify IBAN – confirm the validity of an IBAN before making a transfer.

- IBAN code checker – check digit verification included.

- IBAN lookup service – identify structure, bank, and region details from any IBAN.

Send Money Using an IBAN

Speak with your bank or a financial provider before making a payment. Always verify the IBAN with the recipient.