Currency Transfers with Cambridge Currencies

Fast, Secure, and Cost-Effective International Money Transfers

Looking for the best way to move money across borders? At Cambridge Currencies, we provide smarter currency transfers for individuals and businesses worldwide—offering bank-beating rates, faster settlement times, and expert support every step of the way.

What Are Currency Transfers?

Currency transfers (also called international money transfers or FX transfers) involve converting one currency into another and delivering the funds to a recipient in another country. You might use one to:

- Pay overseas suppliers or contractors

- Send money to family abroad

- Purchase property in another country

- Transfer funds between international accounts

- Manage payroll for global staff

- Hedge against currency risk in business

Banks often charge high fees and offer poor exchange rates. At Cambridge Currencies, we cut the cost, increase the speed, and eliminate the headaches.

Why Choose Cambridge Currencies?

We’re not just another transfer app or online bank. We’re a specialised foreign exchange provider trusted by thousands of clients to move millions daily. Here’s what sets us apart:

✅ Real-Time Exchange Rates

We give you the live market rate—with tight spreads and no hidden markups.

✅ Transparent, Low Fees

Flat pricing. No surprises. We tell you the cost upfront.

✅ Fast Transfers

Same-day transfers for major currencies. Most complete in 1–2 business days.

✅ Fully Regulated

We’re FCA-regulated and compliant with all AML and KYC rules. Your funds are safe.

✅ Personal Support

Talk to a human. Need a rate alert, recurring payment, or strategy for a large transfer? We’ve got you.

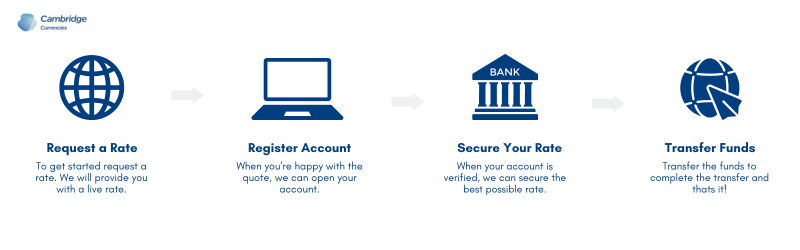

How Our Currency Transfers Work

1. Register for Free

Sign up online. It takes minutes.

2. Get a Quote

Tell us the amount and currency. Lock in your rate instantly—no obligation.

3. Fund the Transfer

Send us your local currency via bank transfer.

4. We Transfer the Funds

We convert and send your money to the recipient’s account abroad.

You’ll get a full audit trail and real-time updates on transfer progress.

Supported Currencies

We support 50+ currencies, including:

- GBP, EUR, USD, CAD, AUD, NZD

- CHF, JPY, HKD, SGD, ZAR

- And more—across Europe, Asia, the Americas, and Africa

Currency Transfers for Businesses

If you’re managing cross-border transactions, supplier payments, or international payroll, we can save your business time and money. Our business FX solutions include:

- Spot and forward contracts

- Bulk and scheduled payments

- Risk management strategies

- Dedicated account managers

- API integrations for platforms and ERPs

Whether you’re a startup or a multinational, we can tailor a plan for you.

Compare Us to the Banks and Transfer Apps

| Feature | Cambridge Currencies | High Street Banks | Transfer Apps |

|---|---|---|---|

| Real market FX rates | ✅ Yes | ❌ No | ⚠️ Sometimes |

| Transparent pricing | ✅ Yes | ❌ No | ⚠️ Varies |

| Personal account manager | ✅ Yes | ⚠️ Maybe | ❌ No |

| Speed of transfers | ✅ Fast | ⚠️ Slow | ✅ Fast |

| Business FX services | ✅ Advanced | ⚠️ Limited | ❌ No |

Frequently Asked Questions

How long do currency transfers take?

Most transfers settle within 1–2 working days. Some major currencies arrive same-day.

Is there a minimum or maximum transfer amount?

We recommend transfers above £1,000. There’s no hard cap—we regularly handle six- and seven-figure transactions.

Do I need a UK bank account?

No. We work with clients globally. All you need is a verified identity and a local account to fund your transfer.

Can I fix a rate in advance?

Yes. We offer forward contracts to lock in rates for future transfers, ideal for property purchases or budget planning.

Start Your Transfer Today

Join thousands who trust Cambridge Currencies for fast, reliable currency transfers—with better rates, smarter tools, and expert help when it counts.

[Get Started Now] – Open a free account in minutes.

Download Our Free Currency Transfer Guide

Want to learn more before transferring? Grab our quick-start guide:

“What’s the best way to transfer money 2025?”

Includes tips, case studies, and rate comparison examples.