Sending Money from the UK to South Africa

- No Hidden Fees

- Competitive Rates

- No maximum amount

How to Send Money from the UK to South Africa: A Complete Guide

If you’re looking to send money from the UK to South Africa, there are several options available. You can transfer funds to family, pay for property, or make a business transaction. In this guide, we’ll answer the most common questions, including “How to send money from the UK to South Africa?” and “How to transfer money from UK to South Africa?”

Let’s dive into the easiest and most affordable ways to get your money across borders.

How to Send Money to South Africa from the UK

There are various ways to send money to South Africa from the UK, each with its own pros and cons. Here’s a breakdown of the most popular options:

1. Bank Transfers

Using a UK bank to transfer money to South Africa is one of the most common methods. Most major banks in the UK allow international transfers, including transfers in South African Rand (ZAR).

- Advantages: Secure and reliable. Most banks offer protection for transfers.

- Disadvantages: Often come with higher fees and less competitive exchange rates.

2. Online Money Transfer Services

Online money transfer services like Wise (formerly TransferWise), Revolut, and Cambridge Currencies are becoming increasingly popular. They attract users due to their low fees. They also have competitive exchange rates. These services allow you to send money from the UK to South Africa quickly. They offer a better rate than many traditional banks.

- Advantages: Lower fees, competitive exchange rates, and faster transactions.

- Disadvantages: Not ideal for those who prefer face-to-face services.

3. International Money Transfer Companies

Companies like Western Union and MoneyGram offer quick and easy money transfers from the UK to South Africa. These services are widely accessible, allowing recipients to collect cash from various locations across South Africa.

- Advantages: Fast and accessible, even in rural areas.

- Disadvantages: Higher fees and less favorable exchange rates compared to online services.

4. PayPal

PayPal is a simple option if both the sender and the recipient have PayPal accounts. You can send money from the UK to South Africa using your linked bank account or credit card.

- Advantages: Easy and convenient for PayPal users.

- Disadvantages: High transaction fees, especially for international payments, and currency conversion fees.

How to Transfer Money from the UK to South Africa – Key Factors to Consider

When deciding how to transfer money from the UK to South Africa, it’s important to consider a few key factors:

1. Exchange Rates

The exchange rate between GBP (British Pounds) and ZAR (South African Rand) can significantly impact the amount of money your recipient will receive. It’s important to compare rates between different services before making a transfer. Online money transfer platforms often offer better exchange rates than banks or cash transfer services.

2. Transfer Fees

Fees vary between providers and can include flat fees, percentage fees, or hidden charges within the exchange rate itself. Always compare fees across services to find the most affordable option. Generally, online transfer services like Wise and Cambridge Currencies offer the most transparent fee structures.

3. Speed of Transfer

How quickly you need the money to arrive in South Africa is another crucial factor. Some services, like Western Union, offer near-instant transfers, but at a higher cost. Others, such as bank transfers, may take 3 to 5 business days to process.

4. Security

When sending money abroad, security is paramount. Banks and licensed money transfer services offer encryption and other safety measures to ensure your funds arrive securely. Always check that the service you choose is regulated by the Financial Conduct Authority (FCA) in the UK. Verify also the relevant bodies in South Africa.

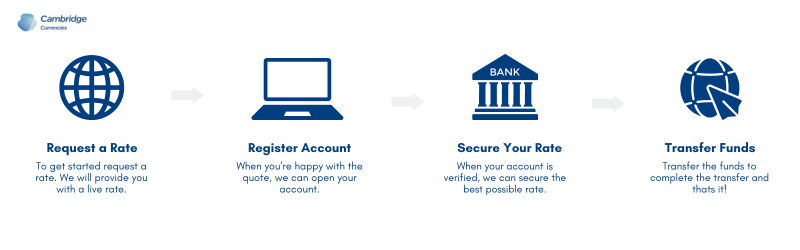

Step-by-Step Guide: How to Send Money from the UK to South Africa

Here’s a simple step-by-step guide to help you send money from the UK to South Africa:

- Choose a Transfer Method: Decide between a bank transfer, online transfer service, or money transfer company.

- Compare Exchange Rates and Fees: Check the exchange rate between GBP and ZAR and compare transfer fees across providers.

- Set Up Your Account: If you’re using an online service, you’ll need to set up an account and provide identification.

- Enter Transfer Details: Enter the recipient’s name, bank account details (if applicable), and the amount you want to send.

- Confirm the Transfer: Double-check all the information before completing the transfer. Most services will give you an estimated arrival time and any associated fees.

- Track the Transfer: Many services offer tracking so you can see when your money has been received.

How Much Does it Cost to Transfer Money from the UK to South Africa?

The cost of transferring money from the UK to South Africa varies depending on the provider. Here’s a quick look at the typical fees involved:

- Bank Transfer: Typically £20-£40 per transfer, with less favorable exchange rates.

- Online Transfer Services: Generally 0.5% to 2% of the transfer amount, with better exchange rates.

- Cash Transfer Services (Western Union, MoneyGram): Can cost up to 5-10% of the transfer amount, depending on the urgency.

Best Practices for Sending Money to South Africa from the UK

To make the most of your transfer, follow these best practices:

1. Use Online Services for Large Transfers

If you’re sending a large amount, consider using an online money transfer service. It should offer low fees and competitive exchange rates. Cambridge Currencies, for example, is a good option for secure, large-scale international transfers.

2. Plan Ahead

If you don’t need the money to arrive immediately, plan your transfer in advance. This will help you avoid paying premium fees for fast transfers. Most standard transfers will take 1 to 3 business days.

3. Watch the Exchange Rate

Exchange rates fluctuate. If you have some flexibility, keep an eye on the rates. Transfer your money when the exchange rate is in your favor.

How to Send Money from the UK to South Africa

Sending money from the UK to South Africa doesn’t have to be complicated or costly. Whether you choose to use a bank, an online service, or a traditional transfer company, the key is to compare your options and choose the one that offers the best combination of low fees, competitive exchange rates, and fast transfer times.

For secure and cost-effective money transfers, consider using [Cambridge Currencies]. You can get excellent rates and transparent fees for all your international payments.

FAQs About Sending Money from the UK to South Africa

What is the best way to send money to South Africa from the UK?

The best way to send money from the UK to South Africa depends on the amount and speed required. For large transfers, online platforms like Cambridge Currencies or Wise offer competitive rates and low fees.

How long does it take to transfer money from the UK to South Africa?

Transfers can take anywhere from a few minutes. This is common with cash transfer services. Transfers can also take 3-5 business days. This usually happens with bank transfers or online services.

Can I send money to South Africa through PayPal?

Yes, but PayPal charges higher fees and offers less favorable exchange rates than dedicated money transfer services.