How to Transfer EUR to USD: A Complete Guide

Transferring money from EUR to USD can be essential for a variety of reasons—whether you’re traveling, investing, or managing international payments. Understanding the exchange rates and market trends is crucial for making smart decisions when converting currencies. In this guide, we’ll explore how to efficiently transfer EUR to USD, along with helpful tips on staying informed with the EUR USD forecast, and why monitoring a EUR USD live chart can save you money.

Understanding EUR to USD Exchange Rates

Before making a transfer, it’s essential to understand how the EUR to USD exchange rate works. The rate fluctuates due to several factors such as global economic conditions, political events, and market sentiment. Keeping an eye on the EUR USD forecast today can help you decide when it’s best to transfer your euros into US dollars.

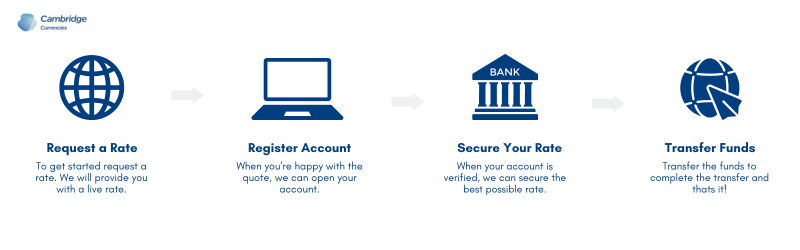

Steps to Transfer EUR to USD

- Choose a Reliable Money Transfer Service: Start by selecting a trusted service that offers competitive exchange rates and low fees. Whether you choose a bank, a currency exchange service, or an online platform, make sure the service you select is secure and provides real-time exchange rate updates.

- Monitor the EUR to USD Exchange Rate: Timing is key when converting large amounts of money. Use a EUR USD live chart to monitor real-time exchange rates. By tracking the market trends, you can spot favorable rates and lock in a better deal.

- Check for Fees and Hidden Costs: Some services charge high fees or offer poor exchange rates. Always compare multiple providers and keep in mind the total cost of the transfer, including fees. Opting for services with low fees and real-time rates based on the EUR USD forecast can save you a significant amount of money.

- Make the Transfer: Once you’re happy with the rate, initiate the transfer through your chosen service. Depending on the service, your transfer can take anywhere from minutes to a few days to complete. It’s always worth confirming the delivery time before finalizing the transaction.

EUR USD Investing: Maximizing Your Profits

For those involved in EUR USD investing, transferring euros into US dollars goes beyond personal or business transfers—it’s an investment decision. The exchange rate can vary widely, and staying updated with the EUR USD forecast can make a significant difference in maximizing profits. Whether you’re buying USD as part of a forex strategy or transferring money for international investments, understanding market movements is critical.

Some helpful tips for EUR USD investing include:

- Stay Updated: Regularly check the EUR USD forecast today to get a sense of where the market is heading.

- Use Real-Time Data: A EUR USD live chart will help you track price changes minute by minute, giving you the insights you need to make timely decisions.

- Long-Term vs. Short-Term: Determine if you’re looking for short-term gains or if you plan to hold USD for a longer period. Your approach will influence when and how you should transfer.

Using a EUR USD Live Chart to Make Smart Transfers

One of the most effective tools for monitoring exchange rates is the EUR USD live chart. This chart displays real-time currency movements, enabling you to make informed decisions when exchanging euros for US dollars.

Here’s how you can use a live chart for transfers:

- Monitor Trends: The EUR USD live chart shows up-to-the-minute data, allowing you to spot trends and decide whether to make your transfer now or wait for a more favorable rate.

- Set Alerts: Many platforms allow you to set exchange rate alerts. This means you’ll get notified when the EUR to USD rate hits a level you’re comfortable with.

- Analyze Historical Data: By reviewing the chart’s historical data, you can understand how the EUR to USD rate has moved over time, helping you to forecast future movements.

If you’re transferring money for business or EUR USD investing, keeping an eye on a EUR USD live chart can make a significant impact on the value you get from your exchange.

EUR USD Forecast: Predicting the Best Time to Transfer

Keeping up with the EUR USD forecast is one of the most important steps when planning your transfers. By predicting how the market will move, you can choose the right time to transfer euros to dollars and potentially save a considerable amount of money.

Factors influencing the EUR USD forecast include:

- Economic Indicators: Pay attention to announcements from central banks, such as the European Central Bank (ECB) or the Federal Reserve. Changes in interest rates or economic policies can heavily influence the exchange rate.

- Global Events: Political events, trade agreements, or international conflicts can cause volatility in the EUR to USD market.

- Market Sentiment: Forex traders and investors react to market sentiment, which can shift due to news reports or economic data releases. Keeping up with these trends will help you predict short-term movements in the EUR USD exchange rate.

Staying updated on the EUR USD forecast today will give you an edge in deciding when to make your transfer.

Efficiently Transferring EUR to USD

Whether you’re planning an international money transfer or engaging in EUR USD investing, it’s vital to keep track of exchange rates and market forecasts. Using tools like a EUR USD live chart can help you monitor real-time movements and maximize the value of your money. Timing your transfer based on the EUR USD forecast can also ensure that you get the most favorable rate.

To learn more about international transfers and get live updates on EUR to USD rates, visit Cambridge Currencies and make the most of your currency exchange.