How To Transfer Euro To Australian Dollar: Your Expert Guide

Sending euros to Australian dollars should not be a hustle. Perhaps you are transferring money to family members, paying for services offered to you, or just managing the expenses of your business; knowing the way forward can help in saving both time and money. In this article, we dwell on all ins and outs on how to make this transfer smooth and cost effective.

The Basics: What You Need to Know

Exchange Rates

What really forms the foundation of every currency transfer however, are the exchange rates. And exchange rates change constantly as a result of market conditions; that’s why getting a good rate is important to ensure your recipient gets as much as possible.

Transfer Fees

Be mindful of the fees charged for transfers. Some charge a flat fee. Others take a percentage of the amount sent. Less favourable exchange rates are another way hidden fees can be charged.

Transfer Time

This can take anywhere from a few minutes to several days or even weeks. Your choice will often depend on how soon you need the individual to get your transfer.

Your Transfer Options

Bank Transfers

They are traditional but secure, yet may charge more and take longer. You’ll need the recipient’s bank information. This includes the IBAN number and the SWIFT/BIC codes.

Advantages:

- High security

- Direct to bank accounts

Disadvantages:

- Higher fees

- Slower processing times

Online Money Transfer Services

Companies such as Wise, PayPal, and Revolut charge smaller fees and have superior exchange rates to the high street banks. These services are faster and easier to use, ideal for much smaller, more regular transfers.

Pros:

- Competitive rates

- Smaller fees

- Quicker processing times

Cons:

- You need to open an account

- You may have transfer limits

Currency Exchange Brokers

If you need to send a large amount, then currency exchange brokers like Cambridge Currencies often offer the most competitive rate. Their core business is foreign exchange; as a result you can receive a more personal service.

Pros

- Excellent rates for large transfers

- Personalized service

Cons:

- Higher minimum transfer amounts

- More complicated to set up

Best Practices to Transfer EUR to AUD

Compare Exchange Rates

- Different providers will have different exchange rates. Comparing exchange rates for banks, currency brokers and online transfer services is going to be very important. This is because even the slightest rate can fade over the amount received.

- Competitive exchange rates characterize Cambridge Currencies, making it an excellent option.

How Much Will I Be Charged for Making a Transfer?

- Besides the exchange rate, the other thing that affects the overall cost of your transfer is the fee for transfer. Some services charge lower fees but with higher exchange rates and vice versa

- Compare providers who show their fees clearly. Sometimes, in the case of large transactions, such brokers as Cambridge Currencies will not charge their fees, hence saving some money.

When to Transfer

- Exchange rates are subject to change as markets fluctuate. You can clinch a better rate by timing your transfer. Track rates using apps and tools, and Casorta will alert you on better rates so that you can make an informed decision.

- Transfers through weekend or holiday when the market is not active may be avoided because it may reflect a fairly less competitive rate of exchange.

Secure ways of Payment

Make sure the service you join has safe methods of payment. Look for providers that have strong security which entails encryption and two-way authentication.

Don’t use cash or checks to make huge transfers; electronic method is safer and quicker.

Understand the Process of Transfer

Get familiar with the process that your provider follows for the transfer of the funds. This includes knowing the documentation, required, the processing times, tracking of your transfer including the.

Tips and Tricks

- Use Online Platforms: Online money transfer services are likely to be cheaper and potentially quicker than getting your traditional bank to do the transfer for you.

- Loyalty Programs: Some providers do offer some kind of loyalty programs or reduced rates for their consistent and regular clients. Enrol for programs to make the best of your money.

- Monitor the Market: Observe the overall happening in the currency market. Through online financial news applications or websites that analyse market trends, you have a way of predicting favourable exchange rates in order to realize maximum Value of Money.

- Negotiate Rates: If you are conducting large transfers, then you should have no qualms about negotiating the rates with your broker. More often than not, you will secure a better deal than the advertised rate.

FAQs: Transferring Euros to Australian Dollars

1) What are the various common methods for sending euros into the Australian dollar?

The most commonly used methods are: wire transfers done by banks, online services of money transfer such as Wise PayPal, Revolut. And also, currency brokers.

2) How can I find the best exchange rate?

By employing an online comparison tool. These will bring rates together and they help you make a selection. Of the most competitive option available.

3) What are some fees associated to a money transfer?

These will be dependent on your selected method. As a general rule, banks are more expensive with worse exchange rates. Online transfer services are generally cheaper with better rates, and currency brokers may give you your best rates big transfers but often have the highest minimums for transfer.

4) How many days does it take to transfer euros to Australian dollars?

Transfer times vary depending on the transfer method:

- Bank transfers: Usually 3-5 business days.

- Online money transfer services: With the majority of online services it is a question of minutes or couple of days.

- Currency brokers: Depending on the service and amount, it can take 1-3 business days.

5) What info do I need to give when making a transfer?

You’ll need the recipient’s bank information like IBAN and SWIFT/BIC codes and also identification documents and the amount to be transferred.

6) Are there any limits on the amount I can transfer?

Yes, limits can be different according to the provider. Online money transfer services normally have lower maximum transfer limits compared to banks and currency brokers, which can handle big or unlimited amounts. Always check provider terms and conditions for this purpose.

7) Can I track my transfer?

The majority of services offer some form of tracking. You will be capable of checking the status of your transfer by logging in to your account on its platform so you can be sure it lands where it needs to.

8) What affects the exchange rate?

The exchange rate will fluctuate with the health of economies, market demand, and even geopolitical events. If you’re planning a big transfer, keeping an eye on these is a good idea.

9) How can I avoid hidden fees?

Always read between the lines and compare not just upfront fees but the exchange rates offered as well so that you don’t get charged with hidden fees. Some services charge lower fees, but offer poor exchange rates, and that will actually cost more.

10) Are online money transfer services safe to use?

Yes, trusted and quality online transfer services utilize the best type of security and encryption on the transactions. Make sure you only use popular and well-trusted services.

11) What happens if my transfer is delayed or fails?

If your transfer has been delayed or fails, get in contact with the customer service of the provider used. They are in a better position and able to help and trace the status with respect to your transaction. Keep some account of details of the transaction.

12) May I cancel a transfer once it has been initiated?

Not all providers will allow cancellations, even if your transfer is pending and has not yet posted to the receiving account. Check your provider’s policies on cancellations.

13) Will I have to pay taxes on my transfer?

Taxes on transfers, of course, vary by the sum and countries. We recommend getting in touch with a tax advisor to get professional help regarding any tax implications in your case.

14) I want to be able to send euros to Australian dollars regularly. Is it possible?

Yes, quite a number of online services of money transfers, and some banks, too – allow you to set up recurring transfers on a regular basis. This is handy for scenarios involving regular bill payments or even salary payments.

15) What are the benefits of using a currency broker for large transfers?

Sometimes currency brokers offer better exchange rates for large transfers and also offer personal services. Sometimes this works in your favour because if you are transferring a big amount of money, the benefits of getting a better exchange rate are immense.

Why Choose Cambridge Currencies to Transfer EUR to AUD

The USD to AUD transfer, Cambridge Currencies ticks the right boxes for the following reasons:

- Competitive Rates: You get the best possible rate without any hidden fee attached.

- Fast and Secure: It offers fast transfer times and robust security in place.

- Personalized Service: You get dedicated support to see you through the process.

Sending euros to Australian dollars does not have to be a pain. Knowing what is available and preparing the ground will make this process efficient and cost effective. Whichever mode you choose-to go the bank way, an online service, or through a currency broker–choosing the right way means doing it the right way so that your money reaches its destination without any hassles.

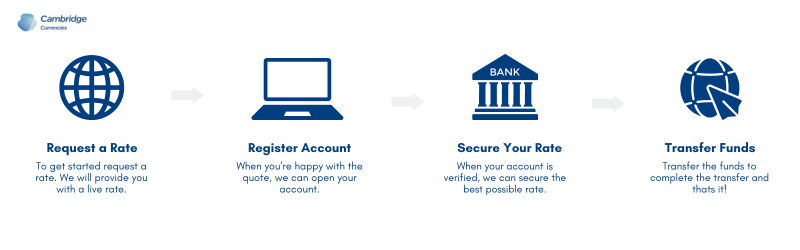

How Cambridge Currencies Works: A Detailed Step-by-Step Guide

Step 1:

Request a Rate

You begin by getting a quote. This takes only a few minutes to do online. In return for asking for a quote you get an actual live quote from Cambridge Currencies that is inclusive of all fees. Being able to see precisely what you are covered for removes the shock that hidden fees can bring.

Step 2:

Register

Once you’re happy with the quote, the next thing for you to do is register. Registering an account with Cambridge Currencies takes only a few minutes or so-quick and easy. You will need to fill in some basic info, although their streamlined registration process allows you to get operational pretty quickly.

Step 3:

Fix your rate

Once your account is opened, Cambridge Currencies will actually lock in the rate while on the phone. This is an important step because it makes sure you get the best possible deal. You are protected from a fluctuating exchange rate since the rate is locked in. That means you’ll know with certainty how much you’ll be receiving on the other side.

Step 4:

Transfer Funds

Finally, you will need to transfer funds required to complete the transaction. Cambridge Currencies will guide you through this so yet again everything will go really smoothly. Once you have transferred funds, that is it! Your money will be on its way to the recipient with that feeling of assuredness that you have made a great deal and received efficient service.

Done

Four steps in total-that’s all it takes for Cambridge Currencies to send your money abroad easily, transparently, and at low cost. A one-time transfer or regular payments-whatever you wish to do, this easy operation and highly competitive rates will make them your preferred choice for currency exchange.