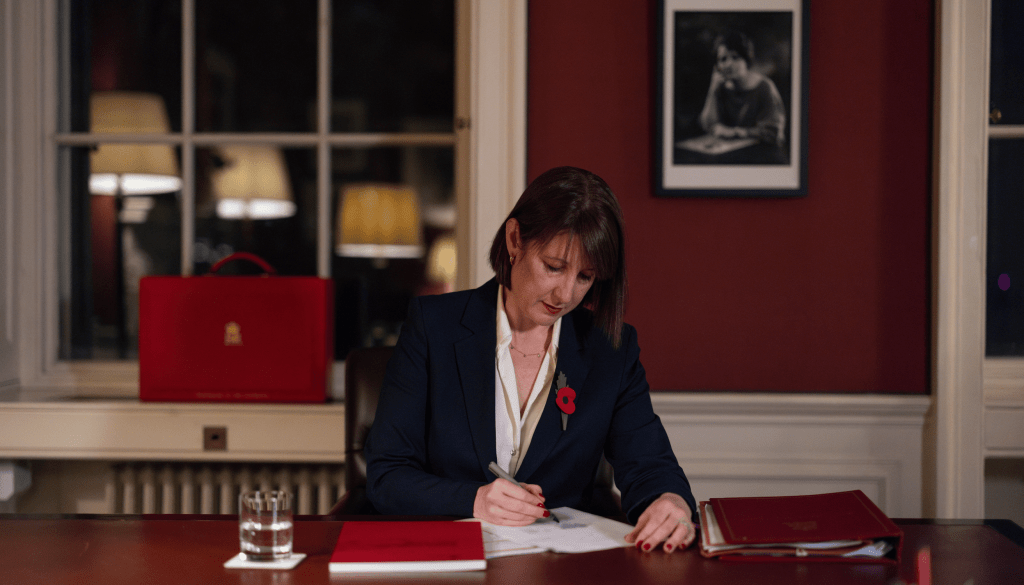

UK Autumn Budget 2024: Everything You Need to Know

How Will Labour’s First Budget Shape the Economy?

Oct 30 2024

Today’s UK Autumn Budget from Chancellor Rachel Reeves is a pivotal step for the Labour government. It introduces a range of strategies across tax, housing, public services, and business. Here is a look at the budget’s changes. We also explore what they mean for everyday taxpayers, businesses, and the economy as a whole.

1. Tax Changes: What’s New?

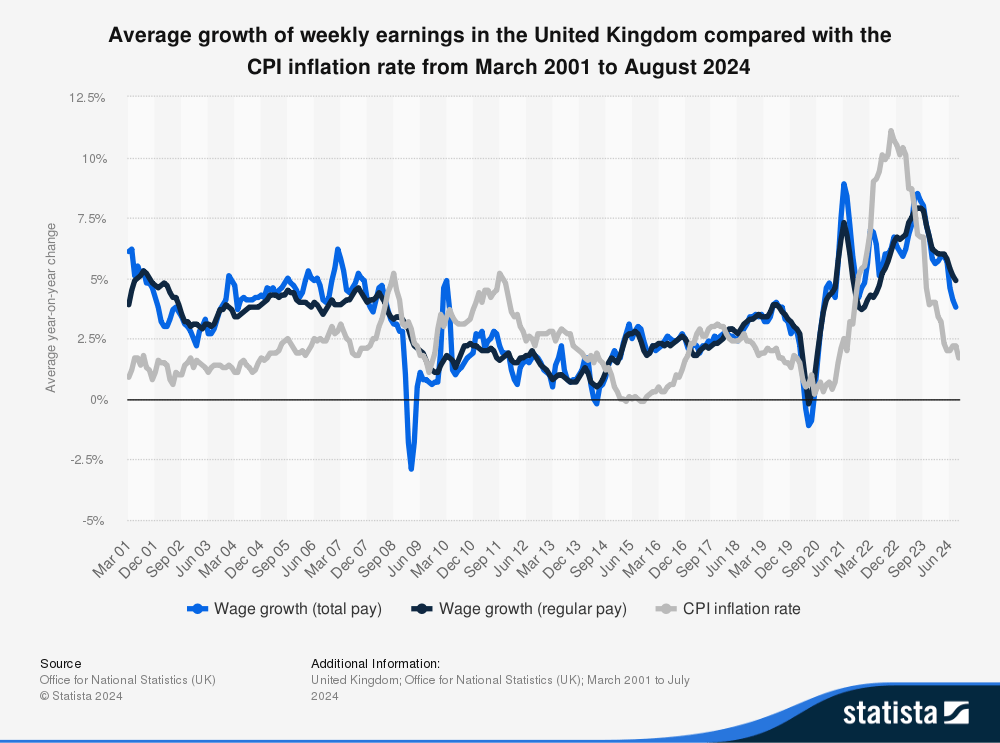

Income Tax Freeze

Income tax thresholds are set to stay frozen. As wages increase, more individuals will move into higher tax brackets, a phenomenon known as “fiscal drag.” This is expected to boost tax revenue by £42.9 billion by 2028. Middle and higher earners will be most affected. They will move faster into the 40% and 45% tax bands. Those earning below £12,570 will see less impact. This shift reflects a growing tax burden on working individuals without a direct tax rate increase.

Capital Gains Tax (CGT)

For investors and high-income earners, adjustments in capital gains tax (CGT) may be on the horizon. These changes could include rate increases. There might also be limited reliefs. Such changes could potentially impact those with substantial portfolios in assets like stocks and property. However, sweeping wealth taxes are not expected, as Labour aims to balance revenue generation with encouraging investment.

2. Housing and Stamp Duty: What Buyers Need to Know

Stamp Duty Thresholds

For homebuyers, the budget suggests a return to pre-pandemic stamp duty thresholds, particularly affecting properties priced between £125,000 and £250,000. This adjustment may result in higher costs for many buyers, especially first-timers. Labour’s proposed mortgage guarantee scheme has a distinct goal. It aims to make it easier for new buyers to secure lower-deposit mortgages. This may potentially offset some of the increased stamp duty burden. Gov.uk – Stamp Duty Land Tax – MoneySavingExpert – Stamp Duty Calculator

3. Council Tax and Public Services: Updates You Should Know

Council Tax Band Updates

The budget suggests adjusting council tax bands to align with current property values. This is especially true in high-value areas such as London. Despite rumors, the single-person council tax discount is likely to remain unaffected. This budget also brings a substantial £1.5 billion boost to the NHS, aimed at alleviating staffing shortages and reducing wait times, reinforcing Labour’s public service priorities.

4. Minimum Wage and Fuel Duty: Everyday Cost Implications

Minimum Wage Increase

From April, the adult minimum wage will rise to £12.21, with even higher proportional increases for younger workers. This change provides a boost for employees but may also impact small businesses managing wage costs in a challenging market.

Fuel Duty Hike

After a decade-long freeze, fuel duty is expected to increase by up to 7p per litre. This rise will likely affect transport costs, with a ripple effect on goods and services reliant on logistics. Small businesses may feel the strain most as both wage and fuel costs climb.

5. Business Roadmap and Economic Stimulus

Tax Simplification Roadmap

Businesses can expect a focus on tax simplification, with a roadmap aimed at fostering long-term investment and planning. Though sweeping reforms aren’t anticipated immediately, gradual changes could make the UK more appealing for investment. Small businesses, however, might feel added pressure from increased wages. The combined costs of wages and fuel duty challenge profitability in the short term.

6. How Will This Affect the Pound?

Pound Stability and Market Confidence

The pound’s reaction will largely hinge on market confidence in Labour’s fiscal management. If tax collections and spending remain balanced, the pound may stay steady or strengthen. Conversely, concerns over inflationary spending could create volatility in the currency market. A hike in fuel duty, for example, could contribute to inflation, potentially affecting the pound’s relative value over time.

Quick Note: Fuel duty increases may contribute to inflation, adding potential pressure on the pound and impacting international purchasing power.

7. Key Impacts and Takeaways

The Autumn Budget introduces various measures intended to balance tax revenue, public service support, and economic stability. Here’s a quick breakdown of what to expect:

- For Individuals: Expect a higher tax burden due to frozen income tax thresholds, especially for middle and high earners.

- For Businesses: Tax simplification is underway, but small businesses may face challenges from increased wage and fuel costs.

- For Homebuyers: Stamp duty costs might increase for certain buyers. A mortgage guarantee scheme could aid new buyers in securing lower deposits.

- For Investors: Potential CGT adjustments may impact high earners with significant investments.

As Labour’s first budget in over a decade, the Autumn Budget reflects the party’s goals. It aims to maintain economic stability while funding essential services. The true test will be whether these changes meet market and voter expectations while encouraging sustainable growth. Financial Times – UK Budget 2024 Coverage