Market Recap: October 14, 2024

Today’s market is shaped by data from Switzerland and China. There are also speeches from central bank figures in the UK, Europe, and the U.S.

Key Data to Watch

Fed Speeches (Kashkari, Waller):

- Fed officials, including Kashkari and Waller, are scheduled to speak later today. Markets will be keen to hear their views on inflation, interest rates, and the overall economic outlook in the U.S.

Swiss Producer and Import Prices (Sep):

- Switzerland’s producer and import prices have declined by -0.1% month-on-month, and year-on-year figures are down by -1.3%. This reflects continued weakness in price levels and could influence the Swiss National Bank’s future policy outlook.

BoE’s Dhingra Speech:

- BoE’s Dhingra is set to speak today. Markets will be listening for any hints about the Bank of England’s future policy decisions, especially concerning inflation control and economic growth.

German Bundesbank President Nagel’s Speech:

- Nagel is expected to discuss economic conditions in Germany, providing key insights into the ECB’s future policy direction as the Eurozone faces ongoing economic challenges.

China’s Foreign Direct Investment (YTD) (Sep):

- China’s foreign direct investment figures are showing a year-to-date decline of -31.5%, reflecting weakening international confidence in the Chinese economy.

OPEC Monthly Market Report:

- The report, released later today, will offer insights into production levels and future demand forecasts for crude oil. This will be critical for oil market participants looking to gauge future price movements.

Energy Markets

- Crude Oil is down by 1.26%, trading at $74.61 per barrel, while Brent crude has also slipped by 1.19%, now at $78.10 per barrel. Both energy commodities are experiencing weekly declines, following a period of volatility.

- Natural Gas prices have dropped by 1.78%, trading at $2.59 per MMBtu, continuing its downward trend from earlier this week.

Gasoline is seeing a modest gain, up 0.55%, priced at $2.13 per gallon.

Currency Movements

- EUR/USD: The euro is trading lower by 0.07% at 1.09276 as markets digest European data and wait for further comments from German and UK officials.

- GBP/USD: The pound is relatively stable, up 0.03%, trading at 1.30680.

- AUD/USD: The Australian dollar is down 0.16% at 0.67381, with pressure coming from ongoing commodity price volatility.

- NZD/USD: The New Zealand dollar is down 0.17%, trading at 0.60986, amid softening market sentiment.

- USD/JPY: The dollar is gaining against the yen, up 0.08%, now at 149.21.

- USD/CNY: The Chinese yuan is slightly weaker, down 0.23% at 7.08351 against the dollar.

- USD/CHF: The Swiss franc is down by 0.12%, trading at 0.85833.

- USD/CAD: The U.S. dollar has gained slightly against the Canadian dollar, up by 0.10% at 1.37766.

Commodities Overview

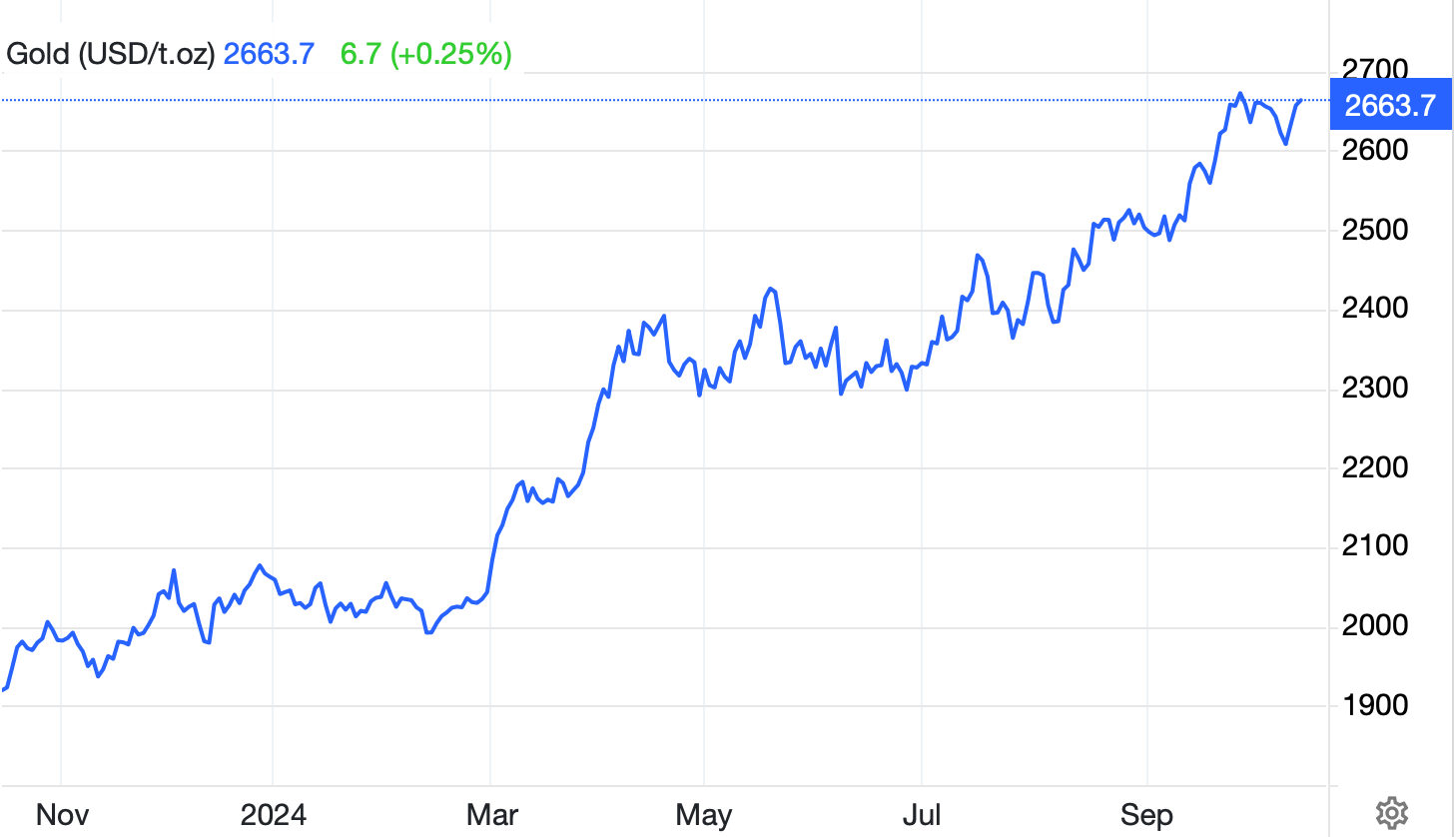

- Gold: is showing positive momentum, rising by 0.31% to $2,665.11 per troy ounce.

- Silver: is flat, trading at $31.52 per ounce.

- Copper: has dropped by 0.88% to $4.41 per pound, continuing its weekly losses.

Things to Watch Out For

Today’s highlights include speeches from the BoE’s Dhingra, Bundesbank’s Nagel, and multiple speeches from Fed’s Kashkari. These will help to provide further insights into future monetary policy directions. Later, the OPEC Monthly Market Report will shed light on the energy sector’s outlook.

Need to Check Live Exchange Rates?

Use our currency converter to get real-time rates on over 100 currencies.