How Long Does an International Transfer Take?

The time required for an international money transfer varies depending on the service provider, destination country, and payment method. Typically, international transfers take 1 to 5 business days, but factors such as bank processing times, holidays, and the speed of the transfer service can influence this timeline. Services like Cambridge Currencies prioritize speed and efficiency, often completing transfers within 24 to 48 hours.

Understanding International Payments Processing Time

International payments processing time varies for several reasons. One key factor is the relationship between the sending and receiving banks. A strong relationship can facilitate a faster transfer, while weaker ties might slow down the process.

Another important consideration is the payment method used. Automated Clearing House (ACH) transfers, for instance, typically take longer than wire transfers. Each method has its own timeline and cost implications.

The countries involved in the transaction also play a role. Some nations have efficient banking systems that process payments quickly, while others may have slower systems due to regulatory or infrastructural challenges.

Currency conversion can add another layer of complexity to the timeline. If the transfer involves different currencies, the additional step of converting currency can delay processing.

Furthermore, anti-money laundering regulations require detailed compliance checks, which can increase processing time. These checks are essential to ensure the legitimacy and security of the transfer.

Lastly, the international payments landscape is continually evolving. Factors such as technological advancements and regulatory changes constantly influence how long it takes to complete an international payment. Understanding these nuances is key to making informed decisions about your international transactions.

International Money Transfer Details Required

To process an international transfer, you’ll need specific information, including the recipient’s full name, bank name, and account number. For transfers using IBAN (International Bank Account Number), you’ll also need the recipient’s IBAN and the bank’s SWIFT/BIC code. Ensuring these details are accurate can prevent delays and ensure your transfer is processed smoothly.

How Long Does an International Payment Take?

International payments usually take 1 to 5 business days. Cambridge Currencies leverages advanced technology and efficient processes to ensure payments are completed quickly, often within 24 to 48 hours.

Key Factors Affecting International Transfer Times

The time it takes to complete an international transfer can be influenced by numerous factors. These factors can range from technical processes to external circumstances.

- Bank Processing Times: Banks have specific cut-off times for processing transactions.

- Sender’s Location: Transfers from different regions may take longer due to local banking practices.

- Recipient’s Country: Processing times vary based on the banking systems in the destination country.

- Currency Pair: Some currencies take longer to exchange due to low trading volumes.

- Payment Method: Transfers initiated via bank accounts are usually slower than card payments.

- Public Holidays: Bank holidays in the sending or receiving country can delay transfers.

- Time Zones: Transfers initiated late in the day may not be processed until the next working day.

- Intermediary Banks: Transfers that involve correspondent banks may experience additional delays.

- Compliance Checks: Security and anti-money laundering checks can lengthen processing times.

- Banking Networks: Transfers within the same banking network are often faster than those involving multiple banks.

- SWIFT vs. SEPA: Transfers using SWIFT may take longer compared to SEPA for Eurozone countries.

- Errors in Details: Incorrect bank details or recipient information can cause delays.

- Weekends: Many banks do not process transfers over the weekend.

- Urgency Options: Opting for regular transfers rather than express services can increase delivery time.

- Third-party Providers: Transfers via third-party platforms may take longer due to additional processing steps.

- Transfer Amount: Large sums may undergo extra scrutiny, slowing down the process.

- Local Regulations: Some countries have strict foreign exchange controls, causing delays.

- Currency Conversion Requirements: Transfers requiring conversions may take longer due to processing time.

- Payment Instructions: Delayed input or errors in payment instructions can postpone completion.

all contribute to the overall time frame of international transfers.

Weekends, Holidays, and Cut-off Times

Weekends and public holidays can halt processing timelines significantly. Banks and financial institutions do not operate on these days, leading to inevitable delays in processing.

Cut-off times are specific deadlines each day after which transactions are processed the next business day. Missing a cut-off time can add at least one full business day to your transfer time.

Understanding the recipient country’s holidays is also important. Holidays in different countries may not align with your own, causing unexpected delays.

Intermediary Banks and SWIFT Network

Intermediary banks are often necessary for facilitating international transactions. These banks add extra steps, which can slow transfers slightly. Each intermediary bank will likely involve additional fees and processing time.

The SWIFT network is a common backbone for these transactions. While generally efficient, the network can have variable speeds due to varying member banks’ resources and technology.

Multiple stops along the SWIFT chain can increase the transfer time, as each member processes the transaction individually. This is especially true when intermediary banks introduce additional checks or documentation requirements.

Currency Conversion and Compliance Checks

Currency conversion is a crucial aspect of international transfers, especially with differing currencies in play. This step can complicate and prolong the transfer process due to rate fluctuations and conversion fees.

Compliance checks for anti-money laundering are necessary, though they may result in delays. These checks ensure the legitimacy and security of every transaction, adhering to international regulations.

Proper documentation is essential for speeding up compliance procedures. Incomplete or inaccurate data can cause additional delays, highlighting the importance of accuracy in transaction details.

How Long Does an Overseas Bank Transfer Take?

Overseas bank transfers typically take 2 to 5 business days, depending on the banks involved and the destination country. Transfers using SWIFT can sometimes take longer due to intermediary banks. Services like Cambridge Currencies minimize delays by leveraging efficient networks for faster processing.

How Long Do IBAN Transfers Take?

IBAN transfers, commonly used in Europe and other regions, generally take 1 to 3 business days. The timeline depends on the payment method, processing times of the sender’s and recipient’s banks, and whether the transfer is made during business hours. Cambridge Currencies optimizes this process to ensure faster transactions.

Frequently Asked Questions About IBAN Transfers

Where Can I Find My IBAN?

Your IBAN is usually listed on your bank statement or online banking account. If you can’t locate it, contact your bank for assistance.

How Long Do IBAN Transfers Take?

IBAN transfers typically take 1 to 3 business days, depending on bank processing times and other factors.

What Happens if I Use the Wrong IBAN?

If an incorrect IBAN is provided, the payment may be delayed or returned. You may also face additional fees, so always double-check the details.

Is IBAN Used Worldwide?

While IBAN is widely used in Europe, many countries outside the region have their own systems. Check with your recipient if you’re unsure.

Do IBAN Transfers Involve Fees?

Yes, some banks or intermediaries may charge fees for IBAN transfers. Cambridge Currencies can help clarify and minimize these costs.

Can I Track My IBAN Transfer?

Many banks and payment providers offer tracking options to monitor your transfer’s progress.

Why Does an IBAN Transfer Take Time?

The time depends on factors like bank processing hours, compliance checks, and intermediary banks involved.

What Details Do I Need for an IBAN Transfer?

You’ll need the recipient’s IBAN, name, and sometimes their bank’s BIC (SWIFT) code.

Details Needed for International Bank Transfer

Accurate details are essential for successful international transfers. You’ll typically need the recipient’s bank account number, IBAN, bank name, and SWIFT/BIC code, along with the amount to be transferred and the currency. Cambridge Currencies ensures clarity in the process, guiding you to provide all necessary information.

List of required details for an international transfer typically includes:

- Recipient’s full name and address

- Recipient’s bank name and address

- Recipient’s International Bank Account Number (IBAN)

- Bank Identifier Code (BIC) or SWIFT code

- Reason for the transfer

While these elements are standard, each transaction might necessitate additional information. It’s always best to verify requirements with your bank beforehand.

Being meticulous with details helps avoid repeated processing attempts. This level of precision can minimize delays caused by data entry errors.

Accurate Beneficiary Information

Ensuring the beneficiary’s information is correct is vital for a successful transfer. Mistakes in names or addresses can lead to canceled transactions or funds being sent to the wrong person.

Recipient details should be double-checked before submission. Any discrepancies, even minor spelling errors, can cause issues.

Verifying these details with the intended recipient before finalizing the transfer can help eliminate potential errors. Accuracy is paramount to avoid setbacks and ensure funds reach the intended account quickly.

Understanding IBAN and SWIFT/BIC Codes

The IBAN and SWIFT/BIC codes are used for most international transfers. Each serves a distinct purpose in the transaction process.

The IBAN is designed to identify individual bank accounts worldwide. It ensures payments are made to the correct account without any confusion or error.Check your IBAN HERE.

The SWIFT/BIC code, on the other hand, identifies specific banks during the transaction. This code is especially important for directing the payment accurately through the banking network. You can check your SWIFT/BIC Code HERE.

Both codes are essential for facilitating efficient and secure international transfers. Confirming these details with your bank can help prevent misrouting of funds.

International Money Transfer Time

The time for an international transfer largely depends on factors like the payment network, currency exchange processes, and banking hours. While standard transfers can take up to 5 business days, platforms like Cambridge Currencies often process them much faster, offering expedited options for urgent needs.

Peer-to-peer (P2P) services are another option, offering competitive processing times and lower fees. They use technology to facilitate direct transfers between users, minimizing intermediary involvement.

Here’s a brief overview of various transfer methods and their typical processing times:

- Traditional bank transfers: 3-5 business days

- Online money transfer services: 1-3 business days

- Peer-to-peer services: Same day to 2 business days

Choosing the right method involves considering both urgency and cost. Each method carries its own set of risks and benefits, affecting the overall user experience.

Traditional Bank Transfers

Traditional bank transfers remain a staple for many individuals and businesses. They are backed by the security and infrastructure of established financial institutions.

Processing times for these transfers are generally longer, taking about 3 to 5 business days. This timeframe includes compliance checks, currency conversion, and settlement processes.

While secure, traditional bank transfers can be more expensive due to higher fees. They are best suited for non-urgent payments where security is a priority.

Online Money Transfer Services

Online money transfer services have revolutionized cross-border payments. These services are typically faster than traditional banks. They streamline the transfer process using digital platforms, reducing both time and costs.

Processing times for online services often range from 1 to 3 business days. This is because they bypass many of the traditional bank protocols.

Fees are typically lower, making them an attractive choice for cost-conscious users. They offer a blend of speed and affordability, ideal for most daily transactions.

Peer-to-Peer (P2P) Services

Peer-to-peer services are gaining traction for their quick processing capabilities. They facilitate direct transactions between two parties via digital platforms.

P2P services often complete transfers within the same day or up to 2 business days. They minimize the traditional banking steps, offering efficient and cost-effective solutions.

These services often leverage innovative technology, like blockchain, to enhance security. Their lower fees make them appealing to users seeking budget-friendly options.

How Long for Overseas Money Transfer?

Overseas money transfers can take anywhere from a few hours to several days, depending on the service provider. Cambridge Currencies ensures competitive speeds and efficient processing to reduce waiting times, keeping you informed every step of the way.

How to Speed Up Your International Payments

- Provide Accurate Information: Double-check account numbers, IBANs, SWIFT codes, and recipient names.

- Choose Fast Payment Methods: Opt for express or same-day payment options.

- Send During Business Hours: Avoid weekends, public holidays, and late-day transfers.

- Use Local Banking Networks: Transfers within the same banking network are usually quicker.

- Partner with Specialists: Work with currency transfer providers for faster processing.

- Plan Around Currency Cut-Off Times: Initiate transfers before daily cut-off times.

- Avoid Common Errors: Verify all payment details and avoid typos or incomplete information.

- Leverage Tracking Tools: Use services that offer real-time tracking to monitor progress.

- Prepare for Compliance Checks: Ensure documents and payment reasons are readily available.

- Communicate with the Recipient: Inform them to confirm receipt promptly.

Choosing the Right Service for Your Needs

Selecting the right service is key to faster international payments. Evaluate services based on speed, fees, and reliability. Reputable providers often have proven track records for efficiency.

Consider service reviews and customer feedback as part of your decision-making. This insight reveals the true speed and reliability of the services.

Explore options that match your frequency and volume of transfers. Some services cater specifically to high-volume or recurring transactions.

Planning Ahead for Urgent Transfers

When urgency is a factor, advanced planning becomes essential. Anticipate potential delays like weekends and holidays when setting transfer timelines.

Opt for services that offer expedited transfer options for time-sensitive needs. Be prepared to pay a premium for express services if necessary.

Ensure all documentation is ready and thoroughly checked in advance. Early preparation helps avoid mistakes that could slow down the payment process.

How Long Does a Bank Wire Take Internationally?

International bank wires generally take 2 to 5 business days to complete. The timeline can extend if there are intermediary banks involved. Using Cambridge Currencies, you can benefit from faster alternatives, reducing the typical delays associated with traditional wire transfers.

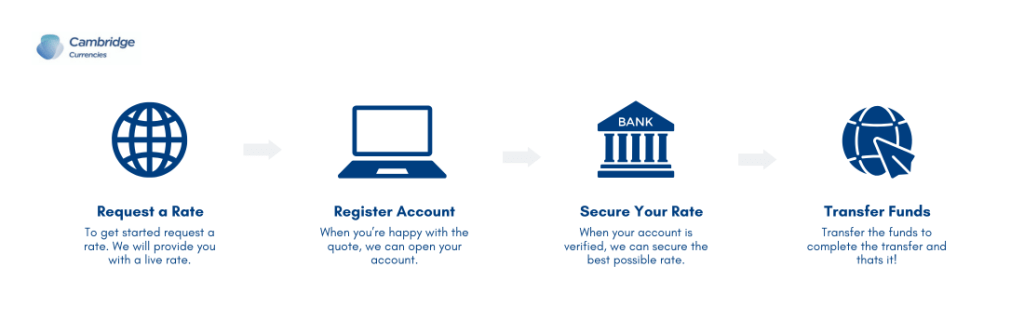

How to Make an International Money Transfer in 4 Simple Steps

Step 1: Choose Cambridge Currencies

To get started when using Cambridge Currencies get a quote.

Unlike traditional banks, we specialize in seamless international transfers for individuals and businesses.

Step 2: Provide Recipient Details

Gather the recipient’s name, IBAN, SWIFT/BIC code, and bank account number.

Cambridge Currencies ensures these details are securely handled for a smooth transfer.

Step 3: Enter Transfer Details

Specify the amount and currency you want to send.

Cambridge Currencies will show a transparent breakdown of rates and fees before you confirm.

Step 4: Confirm and Track Your Transfer

Confirm your transaction, and Cambridge Currencies will handle the rest.

Here’s a quick list of common concerns:

- Transfer Delays: Worrying about how long the payment will take to arrive.

- Exchange Rates: Concern over whether they are getting the best rate available.

- Hidden Fees: Fear of unexpected charges reducing the transfer amount.

- Transfer Security: Ensuring personal and financial information remains protected.

- Incorrect Payment Details: Risk of funds being delayed or sent to the wrong recipient.

- Tracking Payments: Difficulty in monitoring the transfer progress.

- Currency Volatility: Uncertainty about exchange rates changing before completion.

- Compliance Checks: Transfers being held up due to additional verification processes.

- Bank Holidays: Payments delayed by non-working days in the recipient country.

- Recipient Bank Fees: Additional deductions by the receiving bank impacting the final amount.

- Limits on Transfers: Restrictions on how much can be sent at once.

- Refund Policies: Concern over recovering funds if a payment fails.

- Multi-step Processes: Complications due to intermediary banks involved in the transfer.

- Unclear Policies: Difficulty understanding terms and conditions of the service provider.

- Fraud Risks: Fear of falling victim to scams or phishing attempts.

- Tax Implications: Uncertainty about tax liabilities in the recipient country.

- Lack of Transparency: Limited visibility into how fees and rates are calculated.

- Time Zone Differences: Delays caused by differences in business hours.

- Payment Platform Reliability: Concerns about platform downtimes or technical issues.

How Long Do Specific Transfer Types Take?

The time taken for international transfers can vary significantly based on the chosen method. Traditional bank transfers can take anywhere from 2 to 5 business days, depending on various factors like the banks involved.

Wire transfers are typically faster, offering completion within 1 to 3 business days. This depends on the network efficiency and intermediary banks.

Online money transfer services usually offer quicker options. With some services, processing can be as fast as the same or next day, especially for same-currency transfers.

Can You Track an International Payment?

Tracking international payments brings peace of mind to senders. Many banks and online services offer tracking options to monitor the status of your transfer.

This feature often provides updates from initiation to completion, allowing you to follow each stage. Some providers also notify both the sender and recipient upon successful delivery.

If tracking is crucial, choose a service that clearly outlines tracking procedures. This helps you stay informed and promptly address any issues that may arise during the process.

Money Transfer International: How Long?

For international money transfers, the average time ranges from 1 to 5 business days, but this can vary based on the provider. Cambridge Currencies often completes international transfers more quickly, especially when using digital payment methods that bypass traditional banking delays.

Conclusion: Factors Impacting International Money Transfer Times

When asking how long an international bank transfer takes, consider variables like banking networks, intermediary banks, currency conversion, and holidays. To speed up transfers, use a provider like Cambridge Currencies that focuses on efficiency, transparency, and customer convenience.